Back

21 Jan 2020

US Dollar Index Price Analysis: Inverted head-and-shoulders set to lift the greenback

- The inverse head-and-shoulders pattern can lead to more upside.

- Upside targets can be located near 97.85 and 98.20 levels.

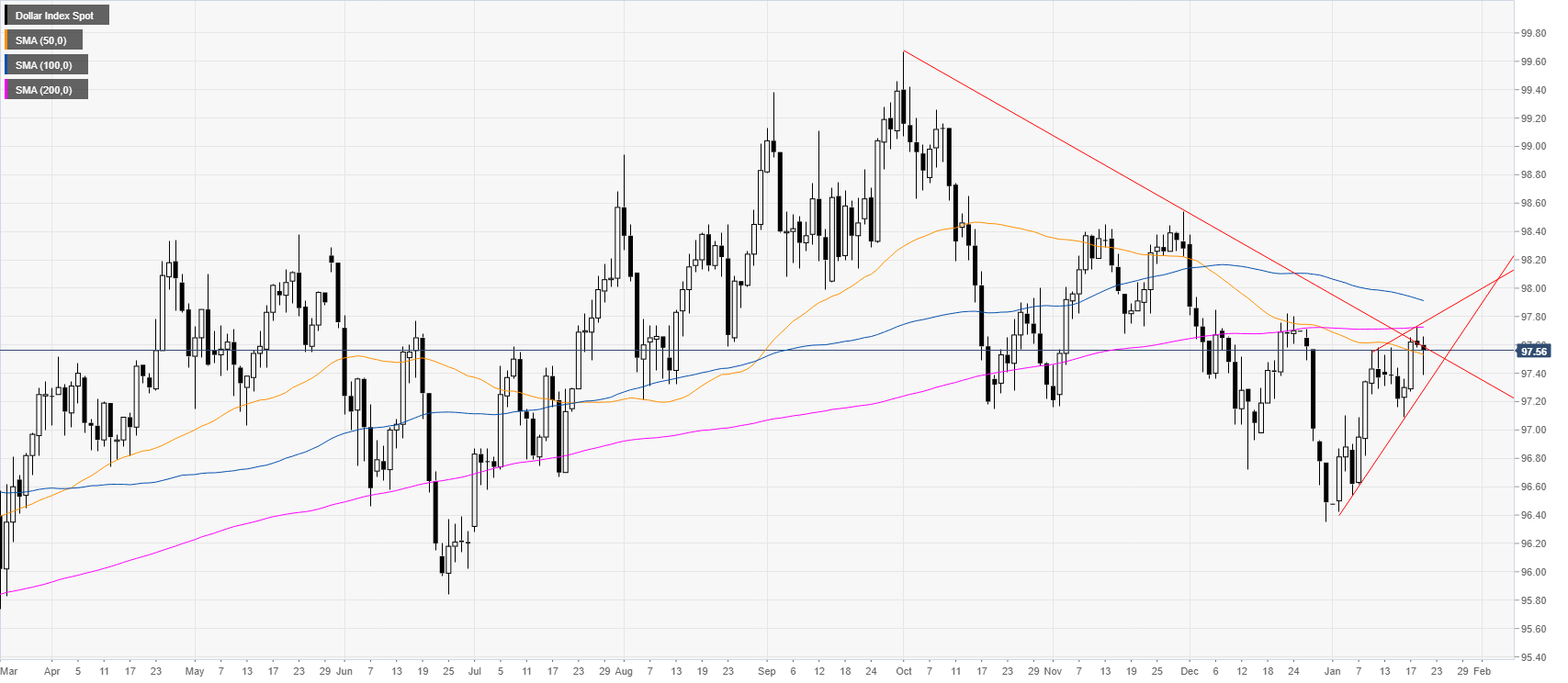

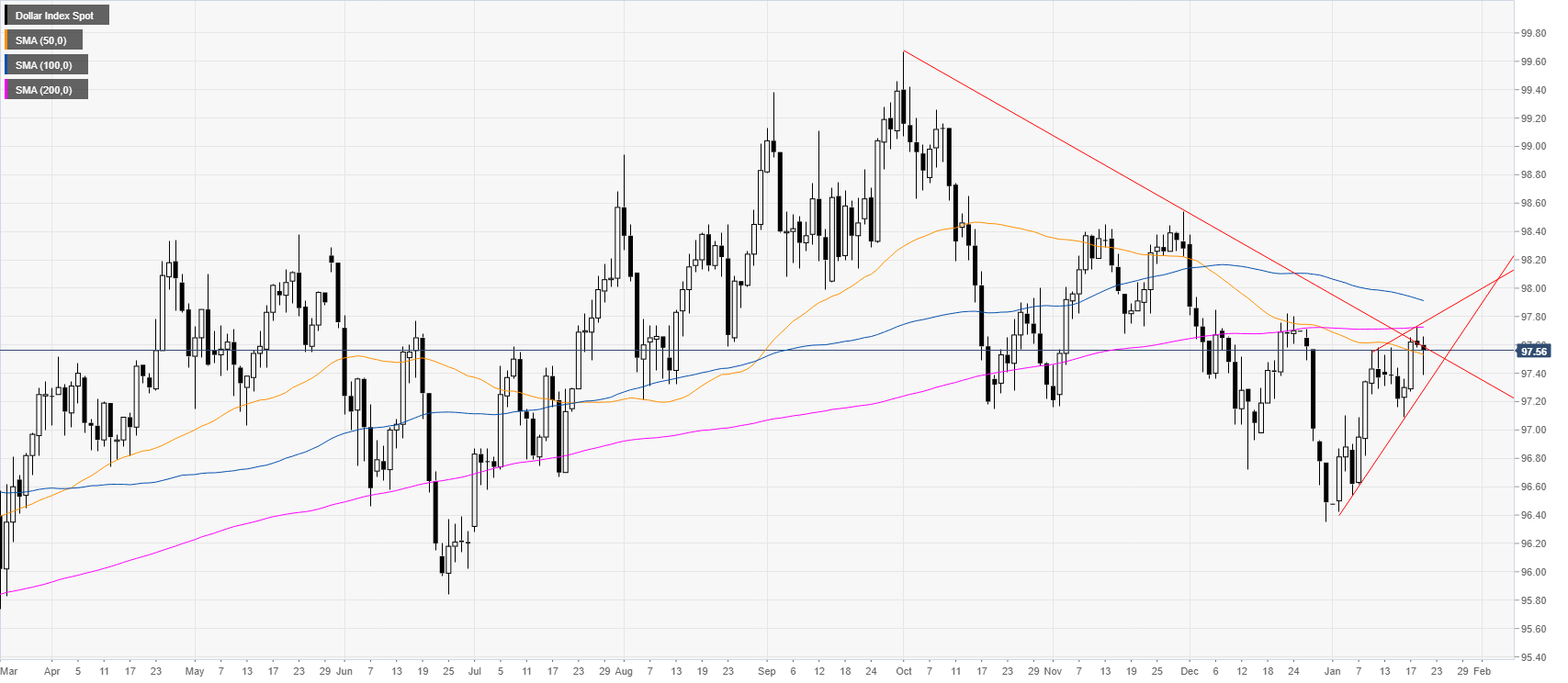

DXY daily chart

The US Dollar Index (DXY) is trading between the 50 and 200-day simple moving average (SMA). DXY is also trading within a rising wedge channel.

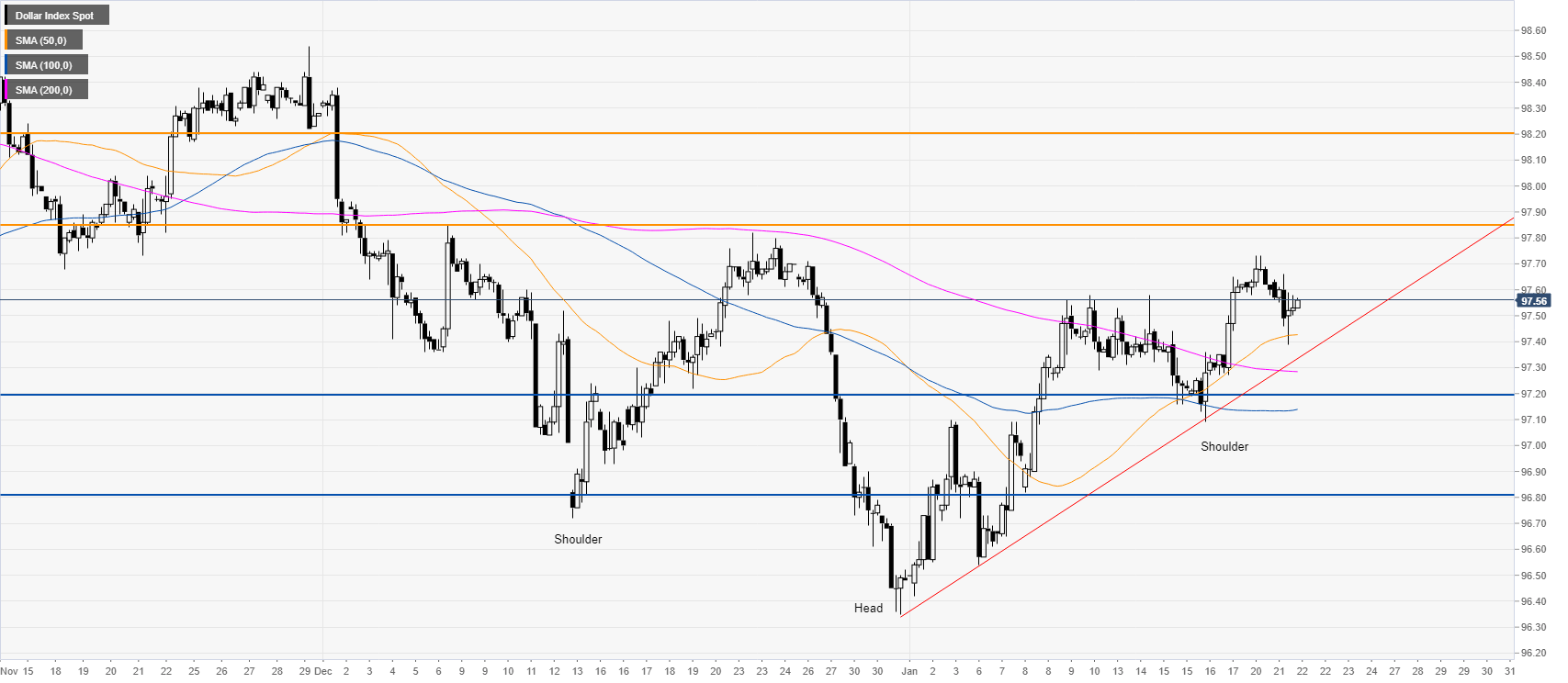

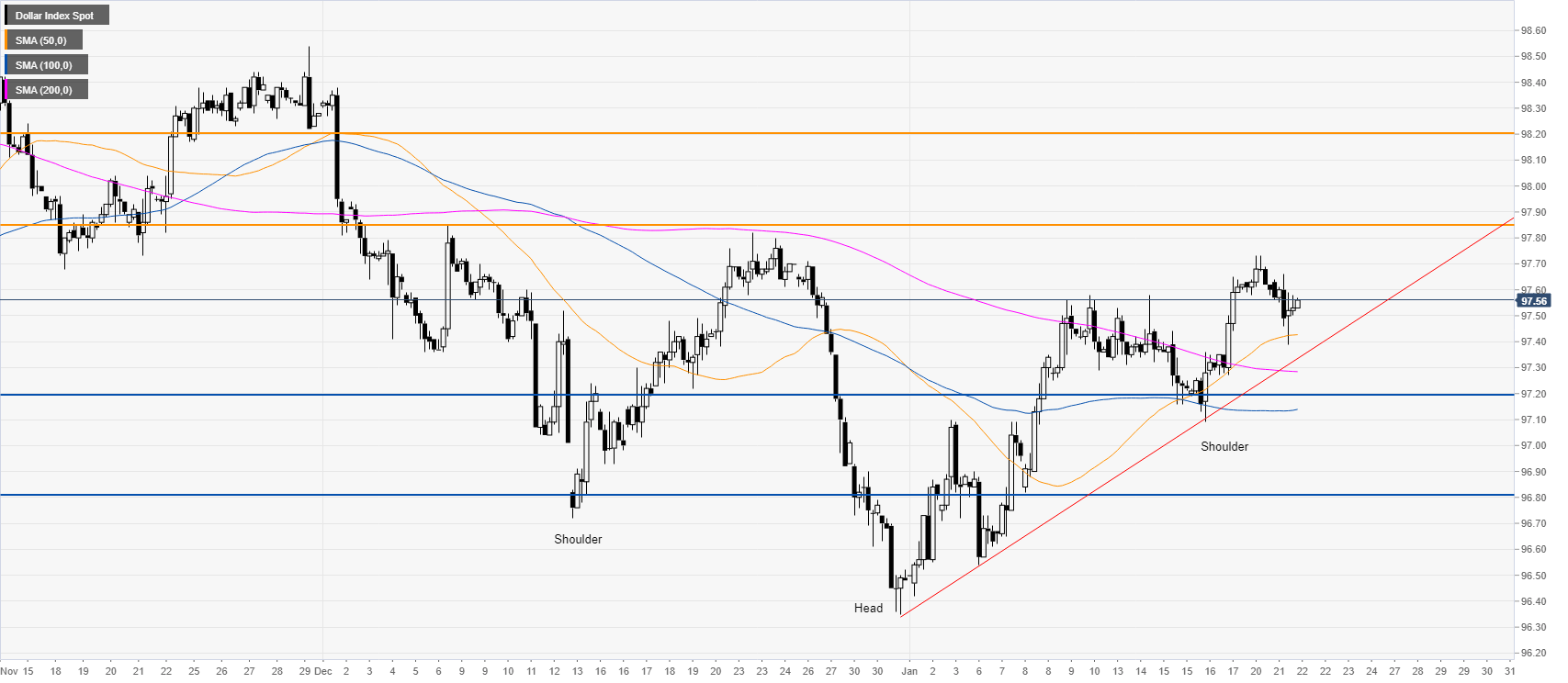

DXY four-hour chart

DXY is trading above the main simple moving averages (SMAs) and a rising trendline, suggesting a bullish bias in the medium term. The greenback is also in an inverted head-and-shoulder pattern and the market could stay bullish while above the right shoulder and the 97.20/10 support zone. If buyers decide to lift the market they could reach the 97.85 and 98.20 to the upside.

Additional key levels