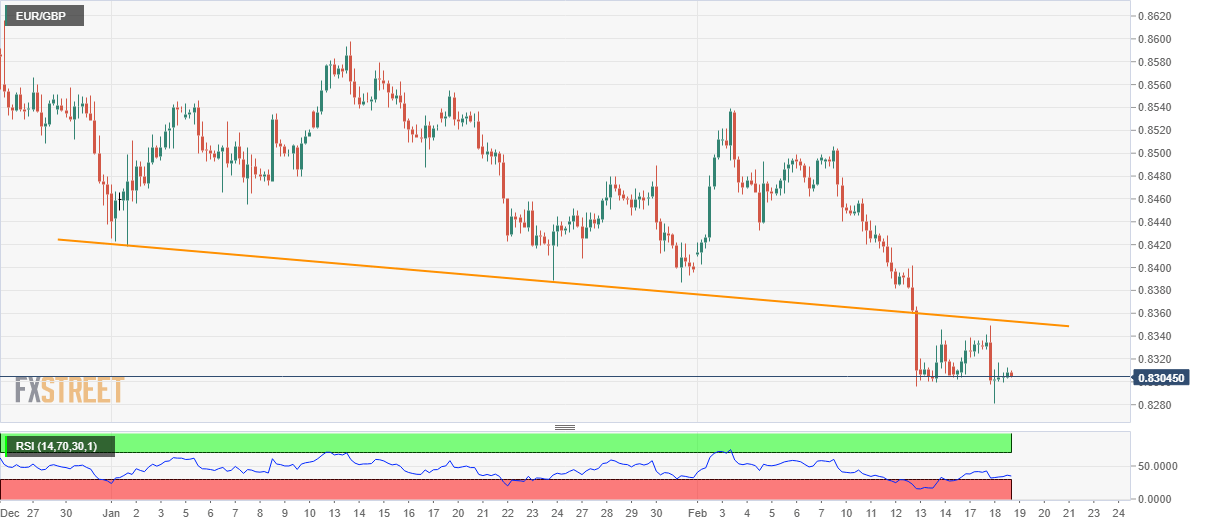

EUR/GBP Price Analysis: Seven-week-old falling trendline guards immediate upside

- EUR/GBP struggles for direction near a 10-week low.

- Oversold RSI favors a pullback but short-term falling resistance line challenges buyers.

EUR/GBP seesaws around the previous day’s close while taking rounds to 0.8305 ahead of the European session on Wednesday. The pair dropped to the lowest in a year on Tuesday but bounced back amid oversold RSI conditions. Even so, a descending trend line from January 01 restricts the pair’s near-term pullback.

Hence, the pair’s recovery to January-end lows near 0.8387 can’t be expected unless it stays strong above 0.8353 resistance-line.

If at all buyers manage to dominate beyond 0.8387, February 05 low near 0.8430 and the monthly top surrounding 0.8540 will gain market’s attention

Until then, sellers will keep targeting December 2019 low near 0.8275 while also aiming for July 2016 low near 0.8250 during further declines.

If prices stay weak below 0.8250, April 2016 top close to 0.8120 could return to the charts.

EUR/GBP four-hour chart

Trend: Bearish